Will Mount Washington Valley Home Values Appreciate or Depreciate in 2020?

With demand surging, low supply could be less of a factor in the upcoming months. At the moment, the primary buyer – the out of state vacation home buyer – shouldn’t even be coming into the state to buy property (and out of state property owners are supposed to “self isolate” – quarantine – lockdown… Which makes it difficult to even list new inventory in the right here and now). There is enormous demand for an out-of-town retreat. The real question is how long this demand is sustained. Fortunately, the Mount Washington Valley has many factors that will influence the local recovery.

Keep in mind that these stats are national, and apply the generalized trends to the North Conway to Ossipee (White Mountains) market, which is rarely even well reflected in statewide stats. Each month the National Association of Realtors (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for the REALTORS Confidence Index. Their latest edition sheds some light on the relationship between seller traffic (supply) and buyer traffic (demand) during this pandemic.

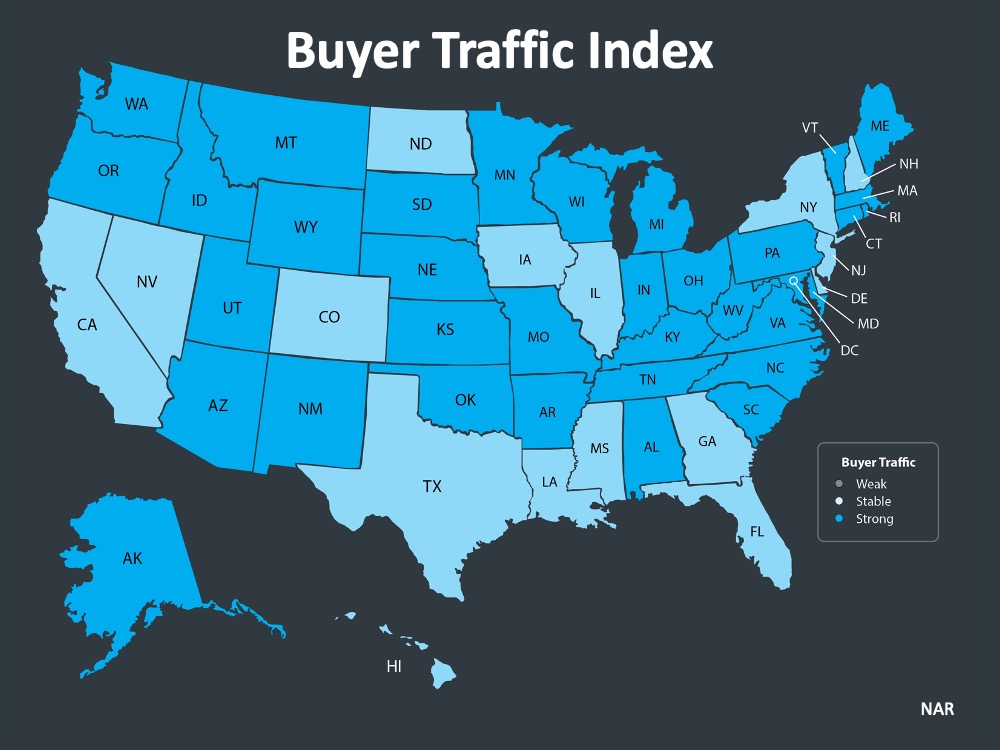

Buyer Demand

The map below was created after NAR asked agents and brokers the question: “How would you rate buyer traffic in your area?”

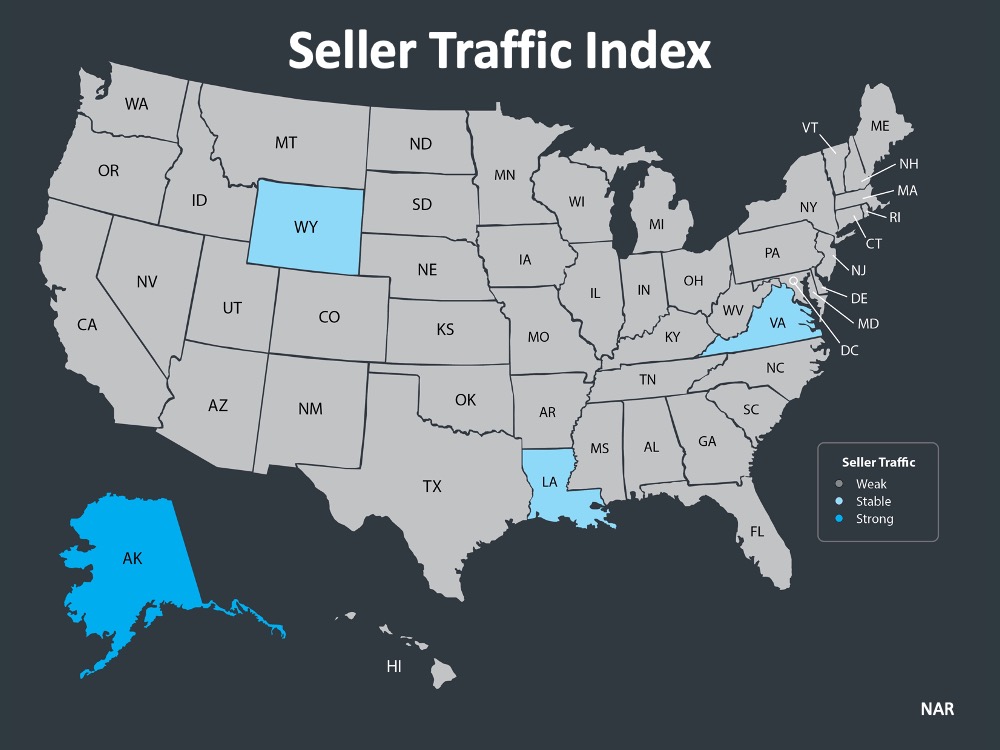

Seller Supply

The NAR Survey index also asks: “How would you rate seller traffic in your area?”

With demand still stronger than supply, home values should not depreciate, even if sales stagnate during the next few quarters. With a surge of buyer activity as the driving force, it should take longer for price drops to stimulate sales, therefore supporting current values. What happens beyond the next year will be hard to predict.

What are the experts saying?

A Snippet of three industry experts on the subject, from Keeping Current Matters, my favorite industry blog:

“We note that inventory as a percent of households sits at the lowest level ever, something we believe will limit the overall degree of home price pressure through the year.”

Mark Fleming, Chief Economist, First American:

“Housing supply remains at historically low levels, so house price growth is likely to slow, but it’s not likely to go negative.”

“Two forces prevent a collapse in house prices. First, as we indicated in our earlier research report, U.S. housing markets face a large supply deficit. Second, population growth and pent up household formations provide a tailwind to housing demand.”

Bottom Line

2020 values have actually escalated / appreciated for us here in the Mt Washington Valley of NH and Maine. Fueled by a desire for a safe retreat and the added benefit of potential rental income (short term rentals) amid the Covid crisis, second home sales are surging. Beyond 2020, however, a sustained shortage of inventory will discourage buyers and reduce the buyer pool and will eventually drive prices down as an aging population decides to sell their vacation property because of all the hype about skyrocketing values. That is when supply begins to normalize to meet the demand. The market correction 12 – 18 months from now is where values will reflect a decline. Many of the factors that come into play beyond my local insight are also showing signs of a housing bubble. If you’re thinking about listing your home, let’s connect to discuss how you can capitalize on the somewhat surprising demand in the market now and make your move before any correction looms big enough to further stall buyer action.